Although I am a licensed attorney, I do not practice law. Yet, I combine my passion for personal finances by helping people as a licensed registered investment advisor and providing holistic wealth advising for goal-oriented individuals. This blog aligns with my passion for sharing my knowledge with goal-driven individuals looking to enhance their financial literacy and amplify their wealth. Welcome!

Are you ready to simplify your finances, achieve your financial goals, and amplify your wealth? Let’s connect! Click the link below to schedule your free 15-minute consultation.

Ask Alissa

Join the Amplify My Wealth community on Instagram and Clubhouse for even more tips, and connect and interact with me on LinkedIn and Clubhouse to learn more ways to amplify your wealth!

Personal Finances 101: Amplify My Wealth

February 17, 2023

How To Improve Your Personal Finances And Financial Confidence

Are you uncertain about your personal finances because you do not know if you will have “enough money”? Improving your personal finances can improve many aspects of your life.

We will set forth how you can improve your personal finances and provide you access to Amplify My Wealth free resources.

How Much Money Is Enough for Your Personal Finances To Be OK

According to Investopedia, Personal Finances refer to

“managing your money as well as saving and investing. It encompasses budgeting, banking, insurance, mortgages, investments, and retirement, tax, and estate planning.”

Investopedia, Kenton, Will. “What Is Personal Finance, And Why Is It Important?” Investopedia. Investopedia US, Web. 16 September 2022.

Your Net Worth

When considering how to manage your money, get an overview of your personal finances.

Seeing how much money you have can be eye-opening.

Your net worth is the value of all your assets minus the total of all liabilities.

To determine your net worth, you need to add your assets (what you own) and subtract all the debt you owe.

When making a list of the value of the things you own, consider such things as your home, properties, and cars. Concerning debt, include it all from credit cards, mortgages, car loans and leases, and student and personal loans.

Tracking Your Net Worth

The Amplify My Wealth Guide Living The Life You Want To Live Guide includes a net worth tracker worksheet to track how you amplify your wealth on your financial journey.

Celebrating your wins along the way results in tremendous success and feeling great about your financial journey.

While knowing your net worth in and of itself will not amplify your wealth, it is enlightening.

Often people equate their financial wealth to how much they have, what they do, or what they earn, overlooking their net worth.

Understanding and tracking your net worth is essential to understand your personal finances. You got this!

Live The Life You Want To Live

It is also essential to first think about the life you want to live.

Ask yourself what you value and set goals that align with your values and will bring you one step closer to living the life you want to live.

Creating a personalized financial plan that includes achievable and measurable steps is vital to increase the likelihood of living the life you want.

Determine the monetary expense to attain each goal.

Amplify My Wealth Goalsetting Calculator

You can access the Amplify My Wealth Wealth Guide To Living The Life You Want and use the accompanying worksheets to write out what you value most and the goals you want to achieve.

It is essential to include short and long-term goals. Visualizing these goals and how they may overlap is vital, too, because otherwise, you may overlook how each goal impacts others and, ultimately, your ability to achieve them.

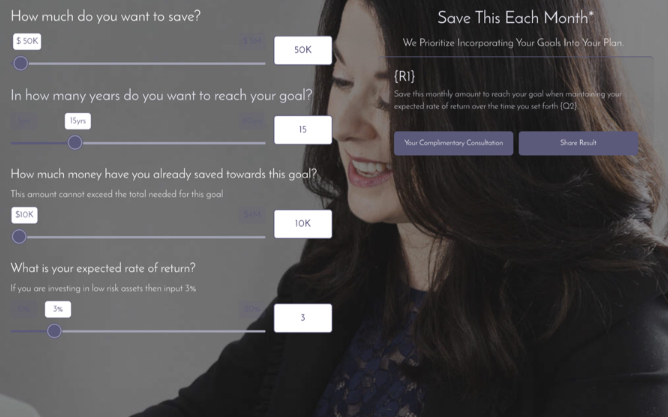

Next, use the SMART goal-setting worksheets and the Amplify My Wealth Goalsetting Calculator to plan for achieving each goal and the steps along the way.

Then, schedule the steps as you would for any appointment.

For example, if you want to fund an emergency account, set aside the time on your calendar to open a high-yield savings account, determine how much you want in that account, and using the Amplify My Wealth Calculator, choose how much to initially transfer and automate regular deposits to that account until you reach your goal.

Your Value-Driven Expense Plan

Creating your value-driven expense plan is an essential part of your financial plan.

Whether you put pen or pencil to paper, prefer a Google sheet, or your favorite spreadsheet of choice, your expense plan will allow you to understand better where your money is going and how you are spending it.

At the top, set forth each resource of net income (after tax) that you have each month. If you get paid every other week, multiply your net income by 26 and divide it by twelve.

After you have listed your net income, gather your bank and credit card statements to assess and determine how you spend your monthly money.

For annual expenses, such as vacations, insurance, and taxes, divide them by twelve so you can account for them with a monthly amount that you can automate to set aside into an account for those expenses.

Celebrate Your Wins

Celebrate the steps you have already taken toward living the life that you want. Improve the likelihood of achieving your goals by ensuring that your expense plan aligns with your values. Before making a financial decision, does this align with my values?

What you value most should be celebrated and not be ignored.

When your personal finances align with your values, you develop better financial habits, feel better about your money, and are more likely to attain the goals you want to achieve and live the life you want.

Revisit the steps in The Amplify My Wealth Live The Life You Want Guide and tweak them regularly. Know that changes are not failures; it is growth.

While this guide shares some of the steps I take with my clients, I personalize it for each client based on what is top of mind for them and those issues that, as a licensed professional, I know need to be addressed sooner rather than later.

This guide is timeless. Ideally, you will revisit and repeat the steps set forth here. Finances are personal.

Determine the frequency best for you, whether quarterly, biannually, or annually. Your financial plan is everchanging, as are your values, goals, risk tolerance, and expenses. While using this guide to help you amplify your wealth, always tweak as needed and celebrate your wins no matter the size and the pivots, as implementing attainable, actionable steps will yield the intended results to live the life you want.

If you have not yet accessed the free resources, we appreciate you and prioritize providing value and protecting your personal information as we do your finances.

Amplify Your Wealth Is Here To Help You With Your Personal Finances

Wherever you are on your financial journey Alissa Krasner Maizes, Esq. is here to help you with your personal finances.

Whether you are a millionaire, living paycheck-to-paycheck striving to eliminate debt, just starting out on your financial journey or looking for a second opinion, Alissa will prioritize you and your personal finances.

Access These Amplify My Wealth Free Resources To Empower You With Your Personal Finances:

- Financial Planning Packages

- Complimentary Consultation

- Follow On Instagram For More Tips

- Access The Amplify My Wealth Guide To Live The Life You Want

- Access The Amplify My Wealth Goalsetting Calculator

Thank You for Taking Your Journey With Me.

[…] course, it is important not to overlook the basics of your personalized financial plan. Personal Finances 101: Amplify My Wealth sets forth the essentials to build a solid foundation for your personalized financial plan. But […]

[…] accounts? Or are you wondering if you already have enough saved for retirement? Consider looking to Personal Finances 101: Amplify My Wealth. Also, you can get more specific guidance on IRA contribution rules on the IRS […]

[…] you are unsure if you “have enough” to fund a 529, consider taking these steps to help you make the best decision and get your free Amplify My Wealth Guide to help you on your […]